There are substantial issues on hand that are pressing, complacency of no other kind, talent development and human management needs to pick up speed and efficiency or there will be chaos.

Call it a Revolution, if you will. Human Talent, Tech Development needs efficiency and speed to succeed – Daniel Mankani

Please allow me to explain.

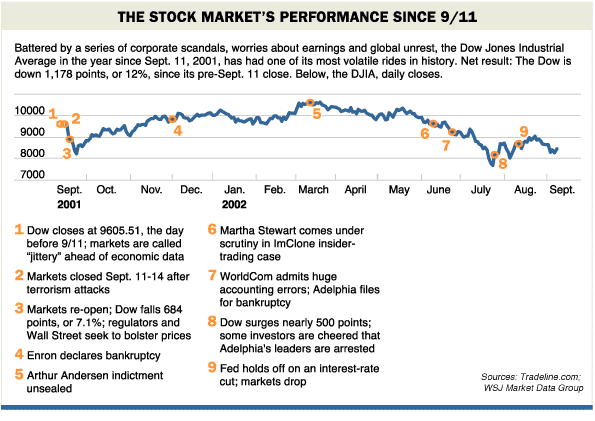

In 2003, when we launched our first book, which is a classical story of the initial days of the Internet, whose history, is very important we document and we did, outlying the dot com collapse, right up to the date it peaked and its subsequent years and challenges thereafter. Those were indeed very harsh times that followed and the peak and its bust was a surprise to many, governments, venture capitalist, the general public, even the smartest guys like us, all were suckered into it at the same time. The Outcome of which is Technopreneurship, the successful entrepreneur in the new economy. today, we wish we paid more attention to the chapter 15; “Role for Society in technopreneurship development.”

Today, its no different.

The time has once again arrived where we are witnessing the secondary main peak of euphoria and complacency and all those fears highlighted in our first book are coming back to haunt us. What it takes to be a successful entrepreneur, was not written by an academic but as a trade book, with real life experiences on how to start up your own internet venture and be successful. Experience has taught us there is no other short cuts from hard / smart work, its only via practicing and failing long enough that open’s up the real knowledge to succeeding.

Automation is picking up speed and there is a good reason behind this, but before we get to this, lets understand what this automation is really doing, its programming the human mind into becoming zombies. There is a huge risk of mental imbalance occurring across the planet and maybe its time for us to realize that the programs only have one purpose, which is to manipulate minds.

Most people only visit ten websites max, day in and day out and its these top ten websites which rake in most of the traffic whilst others have to pay a fee to get access to this traffic. Hence The Gatekeepers. The rest of the treasure trove of knowledge buried much below but many neither have the time, motivation of discipline to explore.

Just look at google, couple of guys wiring together hundreds of machines and building an index, then offering that index as a search engine is fine.

Once they go public, see what happens next.

They become gatekeepers in other words wanting to control everything. The earlier mission statement of Don’t be Evil doesn’t exist.

What was the mission of Facebook, lets be clear and honest about this? Wasn’t it about controlling the human mind and make a zombie out of them and wasn’t it build by a secret organization, that is part of the CIA, NSA.

Can anyone deny this please?

Rumors of facebook been a US Government Surveillance tool made China to create their own. Today, governments are reading everything, the internet is live connected, your devices are live connected, your location known at any given time. You gave them the keys to everything, your privacy doesn’t exist and if you have a camera in your device and a backdoor to the root, then you gave them your view of you in your bathroom as well. How crazy can this be?

Although these are the largest tech companies and have created value on their own in various ways for communities, its their next source of activities is which is causing more mental harm by trying to control thought via perception, turning many into zombies like a swarm of bees of common thought into a collective action for more.

Ideology has great power to convert your best friends into enemies. countries fall and kingdoms disappear when ideologies control human minds. This trend is rapidly increasingly and we see substantial challenges and deterioration in every aspect of human life and economy.

Living in imaginary illusionary lives on Facebook, Twitter, Instagram and various online communities, enhancing self ego which begets bigger ego’s, the smallest people have the greatest need to express their validity but real life is totally different and yet it looks so real, devolving into a public spat’s, more common than anytime before and once it turns ugly, heading down hill pretty past, exposing many things that were never known before.

Everyone is affected. People are losing their minds and going off balance very fast, once this happens, chaos reigns next without knowing how and what caused it in the first place.

Where is the productive personalities that we all want to see and be?, Where is the value creating technology revolution delivering and enhancing of processes and the need to be more productive that we can be. It is after all one life and one shot at it. Instead of what we have is totally unproductive and sometimes a complete wasteful life.

Human evolution has to evolve with its consciousness, the necessities of understanding and self purpose.

Artificial Intelligence by itself has no intelligence on its own, what it rather is, is a set of algorithmic codes running a indexing numbering system based upon which a second set of instructions are undertaken, a simplest form to understand Artificial Intelligence is to realize that its a set of data, possibly even personal to you, based upon which recommendations are made towards you.

A simplest example on how it works on you, is per-determining and recommending based on your past behavior.

Have you ever seen, “We think you may be interested in the following article” or “This may be of interest to you.”, These recommendations are AI.

To reiterate once again, Artificial Intelligence is not intelligence at all, but its based on data and probabilities. For example, if you wanted to create a automated bot of yourself, you will first create a database with a set of data within and create a relationship with queries and give them a ranking of some form based on those rankings, the next outcome is determined, Now you can refer to these as some sort of intelligence, but this is no match to the intelligence of the human mind.

The Internet is semantic and everything online is relating to language or logic in some form, these relationships determine activities for a program to undertake and execute but none of this is rocket science, yet can be driven towards own self interest or greater good for those who are in the know. The concern is the state of affairs for many of those who don’t even know, they are been programmed. Its the distortion of such behaviors that the problem, we are concerned about.

Today, the entire world is invested in the FAANG’S and we don’t think it will always be like this. There will be a fightback from Small Medium Enterprises and from New Technopreneurs, its just impossible that a winners of today are winners of tomorrow as well. Never has been never will be.

The fight back will come and it will take market share off the current established structures, Call it a Revolution, if you will.

FAANG’s | {Facebook, Apple, Amazon, Netflix, and Alphabet’s Google}

We are attending WEB SUMMIT 2017 in Lisbon.

Get to know us.

Technopreneurship – The Successful Entrepreneur in the New Economy – Daniel Mankani. Published 2003. Pearson Education Asia – All rights, copyright reserved Daniel Mankani { ISBN0-13-046545-3 }

Chapter The (False) Hope >>> Technopreneurship-The Successful Entrepreneur In The New Economy.

LINKS

Disclaimer. http://ul3.com/L30qH

Back to the Beginning. http://ul3.com/aeVUG

BTAMSC – http://ul3.com/vAqdH

The Greed: http://ul3.com/pUDgd

The Hope: http://ul3.com/CuC7d

The Ignorant, Zombies: http://ul3.com/PP8Ez

Perception vs Reality: http://ul3.com/UcYb1

History: http://ul3.com/1rCFA

Chart Patterns: http://ul3.com/54VLV

Introduction to Technical Analysis. http://ul3.com/kcYCE

Writings.

INTRODUCTION TO FINANCIAL MARKETS & TRADING OPPORTUNITIES IN COMMODITY, CURRENCY, & FINANCIAL FUTURES. http://ul3.com/dAFWj

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

– Global Economic Collapse January 18, 2016