Back in the earlier days, when data analysis first began, it began with the rationale to predict prices.

Financials traders have always looked for the holy grail, the one that can make you forever RICH.

Financials traders have always looked for the holy grail, the one that can make you forever RICH.

The process begins with an analysis of past data, within such analysis a pattern is observed and judging from the manner the pattern reflects, sooner or later the trader’s mind starts considering what if I bought at those lows and sold at those highs and its sure money.

Last: 2708.50 ESU

Key Support: 2705 2680-2650.

Minor Supports: 2625.50 / 2556.50 / 2426.30 / 2325.00 / 2120.00

Expect Prices upside attempts to be capped below 2750 for a break below 2705 for 2680 region.

Major key support is around 2650. Bear Markets begin often with a downmove of 2% and above

and the way it looks such a move below 2650 confirms indeed.

Look to remain short against historical highs, sideways volatility is increasing which often leads to

bigger concluding days. The move down towards 2400 region is initial short term target.

In the longer term prices will return to the level since Trump Victory as markets often retrace

back to the beginning once the entire narrative has changed.

A 20% and greater move to the downside could begin this week. – Daniel Mankani.

http://dynamictrader.com | DYNAMICTRADER.NET} dynamictrader.org 28-8-2018

Since the early nineties, financial technology has made great progress by leap and bounds, there is no dispute on this. How these technological systems have been developed and how they have evolved into is a big case of false promises.

Today there are big gains in various areas and the progress visible, yet the overall benefits and our current positioning doesn’t bode well for the foreseeable future nor can we say that the benefits we have derived so far, have negligible transformation impacts which are acceptable.

In our last article; 1990’s The End of Real Innovation and Growth.

We argued.

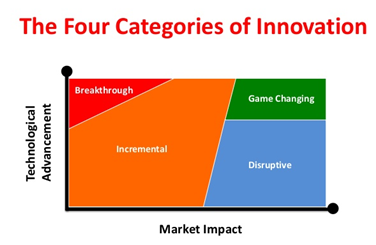

A) Real innovation is value creating and doesn’t cannibalize on the old instead of making those resources available for enhanced usage elsewhere.

B) In 1990’s the end of real innovation. Since then cannibalism on the old, it affects concentrating wealthy gains into fewer and never hands.

C) With the end of real innovation, global growth slowed. Alchemy of Money began, Stimulus became the norm and its leading into A Global Sovereign Debt Crisis.

Innovation is to innovate a process or create a product of enhanced value.

Value creation is a concrete concept and that is why, when one starts to look at how the narrative has changed into what is mine and yours, this selfish bias is where the first miscalculations begin, as the curve is been fitted by extreme optimization to derive the max potentials and when such a system is developed, it falsely assumes that the conditions of the environment is to remain constant and when the environment turns dynamic the system fails.

To give you another perspective on the same scenarios, these days machine learning is in fashion and artificial intelligence is often complimented in the same sentence. So let’s assume you use your ARTIFICIAL INTELLIGENCE SYSTEM TO GENERATE INTELLIGENCE And this as your new innovation claimed by machine learning.

The question to ask here is who is intelligent here then. Is it the man or the machine. And if the machine is being considered to be smarter with the advent of self-intelligent machines then where are the smarter human beings on the planet to take care of those machines for maintenance when needed. Its just not doable and the hype is so far up away in the bubble just in time for a bust when logic and reason is so far away from any factual basis, it’s exactly then when gravity structs and determines. It ain’t far.

Let’s take a look at this from another angle, lets assume that the artificial intelligent bot that you have deployed is making good progress from his ability of predictive behavior and is able to exploit some of that as profit by deploying its highly probabilistic recommended strategies, In such a scenario the bot will be able to profit from it but then one fine day, it will stop working as once everyone else starts to identify that arbitraging edge, they too will start doing it and it will stop working, the arbitrating opportunity automatically disappears.

I will try to explain why this happens and why I feel confident in making this statement that it simply cannot be done on a continuous longer-term basis, once the system corrupts itself by developing bias sooner or later it ends becoming predicative but assuming, since the strategies are identified by past data, that information been in the past and any predictions derived out of them is called hindsight.

To have foresight you need to follow the trend, know the trend and not assume any outcome based on assumptions and nor you can intervene to an extent where you attempt to predetermine the outcome to obviously be favorable to your own positioning, this bias then corrupts the process instead of delivering efficiency, it becomes a case of an inefficient master feeding garbage in {bias} and getting garbage out {cognitive dissonance} and this happens because of the intervention which corrupted the process.

Pattern Recognizance. Looking-out-the-Horizon-Storms-Approaching.

The greatest problem we face today is due to this, the {cognitive dissonance} present in the thoughts today of Industry Leaders, Market Participants and Government Policies are reflected in that.

In essence instead of {derived efficiencies,} inefficiencies are clearly visible and these inefficiencies are having a disastrous effect on global economies. Innovation is not the problem but none of it innovative as cannibalism occurs upon old structures and creates new monopolies concentrating gains and stored energy wealth in the hands of the very few.

This being the new norm of disruptive technologies.

This is the real problem. As the curve is been fitted by extreme optimizations to derive the max potentials and when such a system is developed, it falsely assumes that the conditions of the environment are to remain constant and when the environment turns dynamic the system fails.

At the recent Asian Institute of Leadership Institute 22nd Banking Summit, on behalf of Banking Technologies Asia MSC, I got an opportunity to highlight the effects of these disruptive technologies and the effects of Algorithmic Trading on the financial markets. Outlining these artificial intelligent Algorithmic Trading bots have indeed destroyed the markets efficient process of pricing and the entire hypothesis of efficient markets theory is questioned.

As outlined in the video above, attention is requested to what these algorithmic trading systems and bots are doing to the financial markets, the effects of such systems are destroying the ability of the market to Price Discovery, with the inability to determine price, malinvestment occurs and the market which was supposed to have a price discovering mechanism further worsens making the entire system very vulnerable to greater systematic shocks and even greater market crashes.

[embeddoc url=”http://banktech.net/wp-content/uploads/2018/06/CAN-Machines-think.ppsx” viewer=”google”]

./ stay tuned,

Further Reading

{cognitive dissonance} Animal Spirits, Bubbles, Mania’s and Market Peaks. http://ul3.com/FIl46

{cognitive dissonance} FOMO Signs of the Euphoric. The Bust is almost near! http://ul3.com/6K2S3

{cognitive dissonance} BITCOIN – A Fraud and Ponzi in a Disillusioned World: http://ul3.com/35fH1

{cognitive dissonance} The Greed: http://ul3.com/pUDgd

The Hope: http://ul3.com/CuC7d

{cognitive dissonance} The Ignorant, Zombies: http://ul3.com/PP8Ez

{cognitive dissonance} Perception vs Reality: http://ul3.com/UcYb1

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

– Global Economic Collapse January 18, 2016