High Debts, Stagnating Economy, lead to ww1, ww2, and now ww3. Trade Wars and Sanctions are just the beginning of world war 3. American Supremacy is questioned, Central banks narrative of global growth is collapsing and mirrored in high debts, external enemies are created and fought to keep the narrative alive at home. Is this just not good economics; If we took the narrative of central banks then its indeed “FAKE NEWS”. – Daniel Mankani.

More of that later; but indeed, there is another narrative, Lets look at the cross roads on where the world stands today.

Trends.

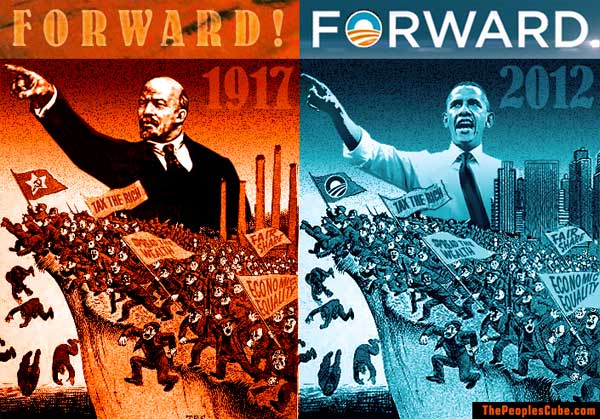

1) Nationalism is rising with it Protectionist Policies.

2) Global Migration is at its highest, mostly caused by prosecution of the free.

3) Economic Transformation mostly driven due to automation and technology.

4) America the accidental empire, global supremacy is been questioned.

5) The Rise of China and the end of Petro-Dollar.

6) The Biggest Elephant in the House called Student Loans.

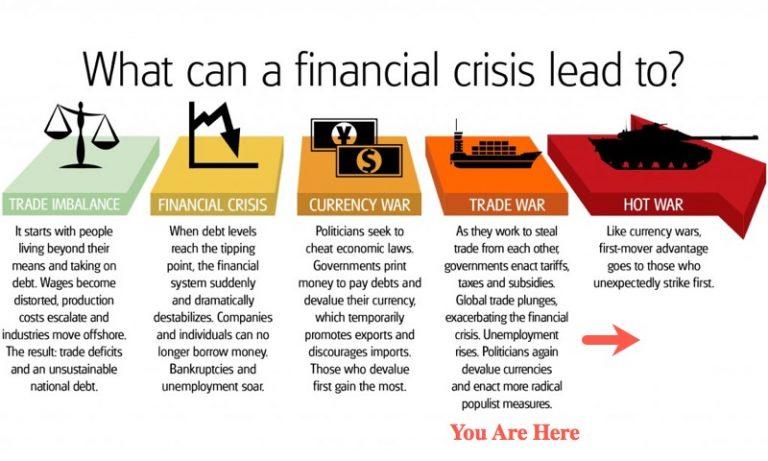

This has resulted in High Debts and a Stagnating Global Economy.

Most of these trends although look coincidental but are systematic and by design.

The Economy is in a constant flux moving from highs and lows, booms, bubbles and subsequent corrections and busts are all part of this ebb and flow. Most importantly in all of these cycles one needs to identify at which stage one is at in the ongoing cycle to act accordingly and if subject of study is price or data then to be successful one is to have no bias and discard all noise.

Its only with such dedication to remain objective with the data and not incorporating our own biases one achieves consistent systematic execution’s and does not need to re-validate his own expectations of taking in subjective biased data which in the end fools no one but the analyst himself.

In light of the Cambridge Analytica scandal with Facebook this has indeed given a very bad name to “Think Tanks or Big Data” companies. Cambridge Analytica was never a big data company, nor a data scientist. They scrapped data which is publicly available and at other times available via data “breaches or leaks”.

Facebook is a marketing company whose main product is “eyeballs, attention spans, page views and clicks”, Every company on the Internet makes money from these “eyeballs, attention spans, page views and clicks”. None of it is hard to understand, if one’s “pay reward” is associated with an “enhanced arbitrage”, then why not, says; the capitalist business world.

FACEBOOK ANALYTICS – The product is you!

{Above Images "Facebook Analytics ; The product is you.}

Fake News

To end the discussion on Fake News!. Its simply what doesn’t fit the narrative of the designer of the system is called Fake News, what doesn’t go with the narrative or perception that has to be created and brainwashed individuals embolden, this is called Fake News and we fired the first warning shots with a debate on illusions and perceptions, if after all governments wants to control their narrative as true and manufacturer conditions to be favorable then this bias is corrupt to the core and will eventually end with disaster as no one can hide from the truth, especially when everything is made transparent via the deployment of technology, therefore its essential to understand the underlying forces of each major trend we are witnessing and you will notice its not much different that before.

At BTAMSC, In our attempt to understand history too. Our Back data is as much as 5000 years. The crisis upon us next is all driven by the simplest of simplest causes, excessive bubbles due to central banks excessive stimulus. The expansion of Monetary Units in order to retain the narrative that all is good and fine when its not. Cause if it is, how do we explain.

A) The Excessive low in lending rates.

B) The expansionary populist policy of doling out money to the masses.

C) Sovereign Budget Deficits and the pile on debt.

D) The hunt for money.. Rising Taxes and Deterioration of the Middle Class.

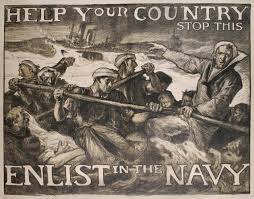

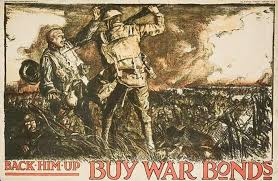

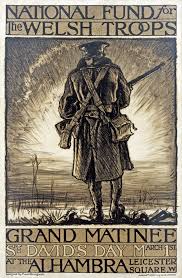

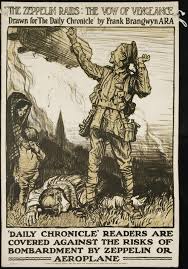

{Above Images, WW1, propaganda machine}

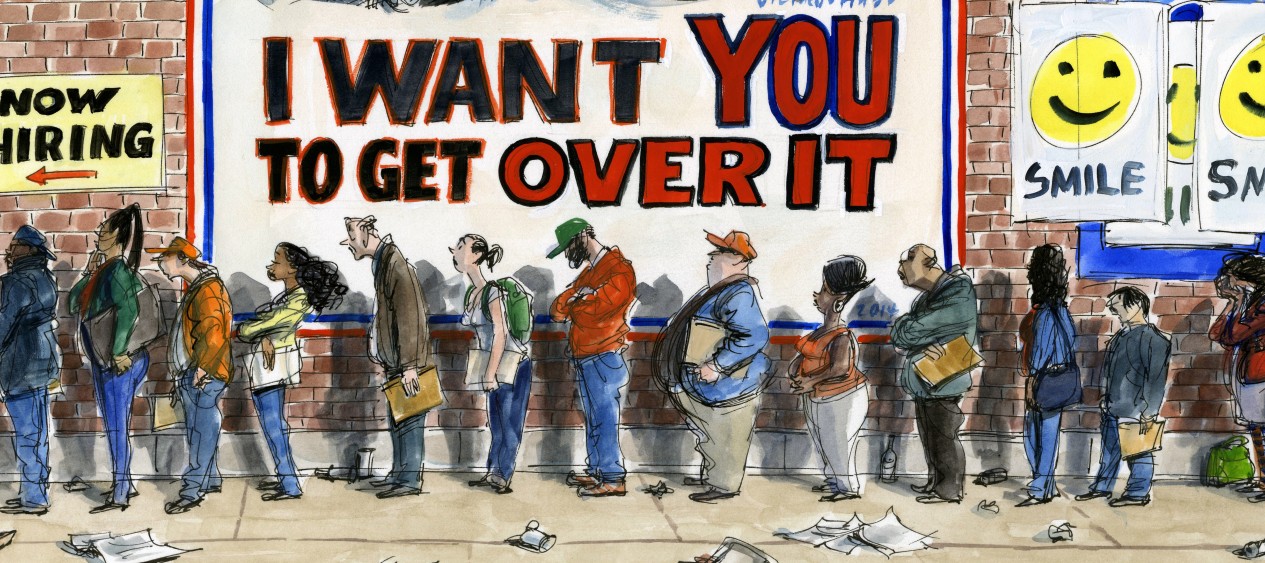

The product is you, every step of the way consent is attempted to be manufactured but the manner in which its undertaken draws to attention that this is indeed dangerous times and everything that you read online is not necessarily true. Its for any and every individual to guess-estimate-validate for themselves what is true. Any other type of system of propaganda falls apart pretty quickly as fast as real time.

This is the age of technology and hence every thing is documented almost immediately in real time, what was said yesterday and what really was true can switch sides and opinions in a matter of minutes as they say in the stock markets, a short against a lie goes down much faster than the one based on the truth, truth therefore is fundamental to any narrative, a rising stock on good fundamentals is evident based on its underlying’s revenues but a buzz stock only lasts high till the buzz is on.

Facebook, Tesla, Linkedin are all fads and they come and go but investors are piled on to such many stocks in the dreams of holding them forever. This complacency will end in tears when the entire world are long the very same stocks, whose stock buybacks rise as many piled on debt to trade their own stocks, so what else is new, exactly the type of story of the roaring twenties and the rise of interest rates, culminating into a massive bust and the great depression in 1929.

Which in turn gave rise to World War 2 and economic prosperity only returned three decades later as nations fought out each other, culminating in the bust of the British empire and making america the accidental empire.

The evidence for this fact is the public exposure of Main Stream Media channels biased against President Trump during the election campaigning or it can indeed also be said that they were reporting the truth, while they were maligned as Biased Channels.

Main Stream Media untruthfulness gave rise to Alternative Media channels, in the end its the traffic and discussions all channels provide and their readerships numbers which manufacturers a certain kind of consent, while the opposing party only other defense is to discredit what doesn’t fit the narrative as fake news, I would say such questioning is actually good making everyone to question everything and to expose more fundamental truths.

However the case, the false narrative can never last long and this causes many more problems. Everyone has the right to develop their own truths and populism brings about them together and results into Nationalism, which in turn has resulted in “closed door policies”, protectionist to varying degrees, with the economy semi autonomously and globally connected via technology and for its transparency that it brings, if untruth facts are inputted and a system designed to fool itself then a systematic crash is bound to happen within crash time frames, which are here now and therefore global trends are dangerous poised as in earlier times.

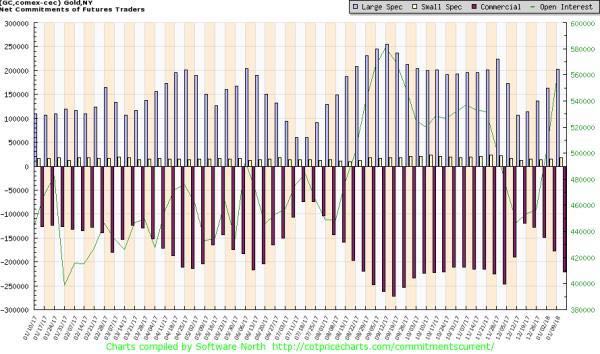

High Debts resulted into malinvestments which in turned wrecked the economy causing it to stagnate as government expenditure continues to rise and the cost spend of all those bills will soon come due. Trade Wars and Sanctions are just the beginning. The wars since 2003 was costly, America is on the edge, losing out its supremacy as all nations have already picked sides, on the economic front a recession is due, at which point the question to ask is; what will the federal reserve do? Continue to hike or let the dollar loose.