Brief: Innovation, growth and human development are closely correlated. Today’s youth are losing their cognitive abilities and problems of today are not with innovation but excessive experimentation.

- 1990’s is when we saw the last bouts of real innovation, 1990’s is also the time frame witnessed when Youth IQ levels have been dropping. The world is indeed dumber and in the quest to access and justify capital, startups and companies tend to pitch artificial intelligence, big data, and autonomous systems simultaneously, when its factual Machines Do Not Think and possibly never will.

- Computing is an execution of systematic codes and programs, they do not have intuition in pattern recognition, which is essentially a key component for innovation.

- The End of Innovation in the 1990’s and the peak of economic growth is correlated and many of the problems we witness today is not due to innovation but rather excessive experimentation which is having disastrous consequences on society.

- As part of a series to delve into these insane experiments, In part 1 we attempt to explain what is real innovation and growth. In part two we delve into the deeper workings of Artificial Intelligence and to explain how unintelligent these systems can be, yet this doesn’t stop experiments into various systems which are purportedly flawed and it continues by those just to be proven right (BIAS) at the huge costs of time and capital, while at the same time unleashing disruptive and destructive conditions on the global economy.

- Use of Smart Phones and dependence on technology are making the youth of today lose their cognitive abilities and the main cause of youths unemployment- Daniel Mankani

1990’s and The End of Real Innovation and growth.

In 1434 Johannes Gutenberg, a goldsmith by profession developed a printing system by adapting existing technologies for printing purposes. In 1712 it was Thomas Newcomen with his “atmospheric-engine” who can be said to have brought together most of the essential elements established by earlier inventors.

Thomas Edison played an instrumental role in the development of the telephone. Edison had been working on methods for sending two messages simultaneously over a single wire for many years. In 1872, after Western Union adopted Joseph Stearns’s duplex for sending two messages in opposite directions, company president William Orton hired Edison to invent and patent other methods “as an insurance against other parties using them.” While working on duplex telegraphs, Edison realized that he could send four messages simultaneously by combining the duplex with a diplex for sending two messages in the same direction.

In 1875, with a contract from Western Union, Edison began work on the acoustic telegraph, which used tuning forks to send telegraphic messages at different frequencies at the same time. He would use this money to build Menlo Park. From this work on acoustic telegraphy, which he pursued at the same time as Alexander Graham Bell, came the telephone, which relied on Edison’s research, and the phonograph, which was inspired by the potential to replicate the sounds of acoustic telegraphy.

In 1875, with a contract from Western Union, Edison began work on the acoustic telegraph, which used tuning forks to send telegraphic messages at different frequencies at the same time. He would use this money to build Menlo Park. From this work on acoustic telegraphy, which he pursued at the same time as Alexander Graham Bell, came the telephone, which relied on Edison’s research, and the phonograph, which was inspired by the potential to replicate the sounds of acoustic telegraphy.

It was Edison’s Carbon Microphone in the receiver that was licensed by Bell and remained in telephones for more than a century. By 1876 Alexander Graham Bell is credited with the development of the first practical telephone, who too recognized the contributions of earlier inventors and with that came we got the Phonograph in 1877 and the lightbulb in 1878.

All these inventions effectively led to enhanced economic activity and an improvement into human conditioning, which prior to were a drag on society and economic participation limited to agrarian communities as men slogged at the farms while women in charge of the households were mostly left to draw water from distances, doing laundry which took up two days in a week and without electricity it meant hard laborious conditions for day to day life.

In 1903 the Wright brothers achieved the first powered, sustained and controlled airplane flight and two years later they broke their own milestones when they flew their first practical airplane, here again, made possible by drawing upon findings from earlier inventors and their observations.

By 1941 a new device came along which could be instructed to carry out sequences of arithmetic or logical operations automatically or via program codes and this became the first computing machines whose costs of ownership were prohibitively very high and were only used by governments for record keeping and instantaneous calculations.

In 1965 Gordon Moore observed the trend at which transistors chips were evolving made a prediction in his paper described a doubling every year in the number of components per integrated circuit and projected this rate of growth would continue for at least another decade. In 1975, looking forward to the next decade, he revised the forecast to doubling every two years.

And by late 1970’s and as predicted by Moore’s Law we saw the advent of the microcomputers and with affordability came mass adoptions of these machines. But these machines were standalone independently working machines thereby as a means to natural progression saw the advent of the Internet, allowing connectivity and collaboration as a means for enhanced efficiency.

Beginning from the early inventions in the 2nd century until the creation of the Internet in the 1990’s, all of the inventions were addressing problems for which there were no other real alternatives. They were fulfilling a real gap market demand followed with their efficient uses and instrumental problem solving, new industries sprung around them, and they had a powerful impact for all mankind, where human life and conditioning vastly improved.

These Real Inventions are in use even today and they can never be dislodged. With the end of these innovations, global growth collapsed and has been tepid since the early 1990’s. The end of real innovations has brought us to a stage of disruptive inventions which are cannibalistic in nature and as solutions to problems where none are required yet have a profound market impact and are reversing some of the positive traits built up in the past and are very destructive in their approach, affecting human conditioning not for the better but towards the worst.

Innovation and Growth

The wider implications of all innovations are strongly correlated between technological advances and the betterment of human life. For example, the Agricultural Revolution which occurred between 1750-1900 produced a transformation of human society brought about by the invention of the plough, making large-scale agriculture production possible. There was also a widespread replacement of manual labor by machines during the Industrial Revolution.

The Invention of the plough didn’t make the cows who plowed the fields obsolete but in fact, they had a positive impact where their old structural uses were enhanced and were made ready for other more efficient uses. Similarly, the impact of paper on record keeping, the compass for navigational purposes and the printing presses as an incremental innovation created, even more, uses for paper.

The Industrial Revolution too brought about much economic improvement for most people in Industrial Societies and many also enjoyed greater prosperity and improved conditions, modern industrial life also provided a constantly changing flood of new goods and services giving consumers more choices, which in turn provided employment opportunities for those displaced by the transformation of the agricultural societies.

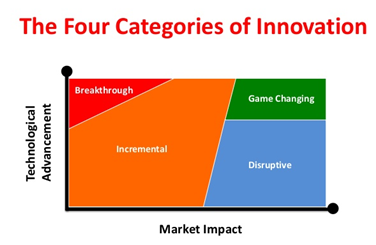

Innovation can be classified as Breakthrough, Incremental, Game Changing and Disruptive.

Innovation can be classified as Breakthrough, Incremental, Game Changing and Disruptive.

Breakthrough Innovation: Often referred to as “revolutionary science” because it involves a paradigm shift. In this case, the problem is well defined, but the path to the solution is unclear, usually because those involved in the domain have hit a wall. Paper, Transistors and the discovery of the structure of many molecules including DNA are both good examples of breakthrough innovation.

Incremental Innovation: (sometimes referred to as sustaining innovation) uses existing forms as a starting point and either makes incremental improvements to something or some process or it reconfigures it so that it may serve some other purpose.

While Breakthrough and Incremental Innovations have a substantial impact in technological advancement and are directly correlated with the advancement of human conditioning and economy, Game Changing and Disruptive Innovations, on the other hand, are not well defined nor can be considered as a new scientific innovation but rather delivers the same repackaged in a different manner.

Game Changing Innovation: For Instance, Apple’s iPhone is not a new scientific Breakthrough Innovation but uses a combination of existing technologies such as the camera, the computer or the many components of the smartphone which were incorporated to create another phone, thereby making it just a game-changing innovation. The iPhone is also not an Incremental Innovation as that of printing press creating efficient enhancing uses of the paper, it did not make any of its components more efficient.

Disruptive Innovations: The term was defined and first analyzed by the American scholar Clayton M. Christensen and his collaborators beginning in 1995 and has been called the most influential business idea of the early 21st century and defines Disruptive Innovation as one that creates a new market by providing a different set of values, which ultimately (and unexpectedly) overtakes an existing market. In business, a Disruptive Innovation is an innovation that creates a new market and value network and eventually disrupts an existing market and value network, displacing established market-leading firms, products, and alliances.

Beyond business and economics, Disruptive Innovations can also be considered to disrupt complex systems, including economic and business-related aspects. The business environment of market leaders does not allow them to pursue Disruptive Innovations when they first arise, because they are not profitable enough at the start and because their development can take scarce resources away from sustaining innovations (which are needed to compete against current competition) and due to these innovations not clearly being defined, they may never be profitable and carry a much higher risk than every other type of innovation.

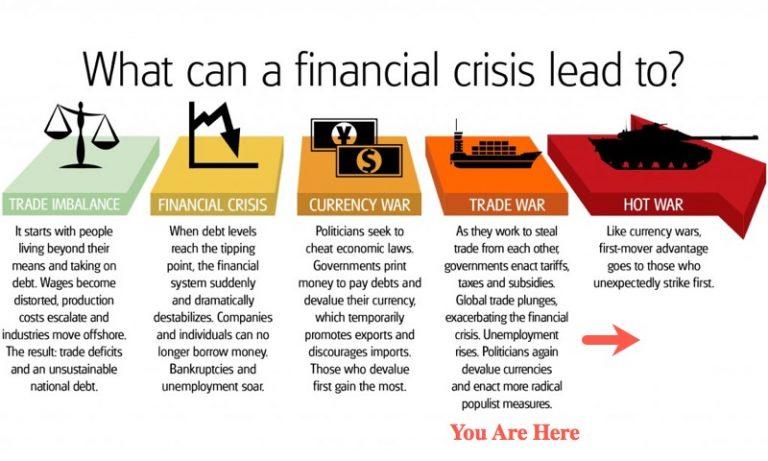

Real Breakthrough Innovations and growth go hand in hand. With computing came the internet in 1990’s and this is to be considered as the last bouts of real inventions the world has ever seen, Global Growth to has faltered in the 1990’s, first with the collapse of the Japanese Economy and the rise of China {cannibalistic}, this being not much different than Japan in the 1980’s. In fact, many of the trade issues we see today between China and USA are about the same of what we witnessed between Japan and USA then.

The innovations since 1990’s have mostly been computer related, which is to follow generalized sets of operations, called programs. These programs enable computers to perform an extremely wide range of tasks, which the newfound computing capabilities could perform well, first as a means of efficient record keeping, storage and with that effective collaboration of these informational data across multiple channels via the Internet.

Out of these new means of efficient storage and communication, Information Technology was born which in turn provided the ability for managers of such systems to identify repetitive and often redundant processes whose removal created new value chains of efficiency.

These new computing innovations while delivering informational competencies, their deployment was destructive in their approach and threatened every set of old established structural system, initially their value proposition was mainly positive as the benefits were visible in the overall bottom line of the organizations who deployed them in the form of enhanced productivity, service, efficiency and or sales, often referenced as Value Chains yet they were cannibalistic in their approaches.

While smartphones and related mobile technologies are recognized as flexible and powerful tools that, when used prudently, can augment human cognition, there is also a growing perception that habitual involvement with these devices has a negative and lasting impact on users’ ability to think, remember, pay attention, and regulate emotion.

As portable media devices, such as smartphones, have become an increasingly pervasive part of human lives, they have also become increasingly capable of supplementing, or even supplanting, various mental functions. With the capacity to be used as phonebooks, appointment calendars, internet portals, tip calculators, maps, gaming devices, and much more, smartphones seem capable of performing an almost limitless range of cognitive activities for humans and by doing so limiting humans own cognitive skills in a case of use it or lose it.

As observed on Moore’s Law on the level of Transistors on integrated circuit chips, if human’s cognitive skills are in decay and reversing then surely this is not a good thing for society and this is reflective of the lack of jobs for today’s youth as they remain poorly equipped despite having participated in higher levels of education and the problem is not with the availability of jobs but the availability of the skills sets they have to offer.

In Business too, these informational technological systems have created havoc by deploying an arbitrage edge for themselves often at the costs of society. Value Creation is a concrete concept which none of these new technologies seem to deliver. The end of innovation in the 1990’s and the beginning of experimentation is at the root of our problems.

Further Reading

Animal Spirits, Bubbles, Mania’s and Market Peaks. http://ul3.com/FIl46

FOMO Signs of the Euphoric. The Bust is almost near! http://ul3.com/6K2S3

BITCOIN – A Fraud and Ponzi in a Disillusioned World: http://ul3.com/35fH1

The Greed: http://ul3.com/pUDgd

The Hope: http://ul3.com/CuC7d

The Ignorant, Zombies: http://ul3.com/PP8Ez

Perception vs Reality: http://ul3.com/UcYb1

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

– Global Economic Collapse January 18, 2016