The greed

Late 1998. A company called theglobe.com was listed on the Nasdaq. With no prior history of revenues and no prior track record the companies listing debut was very well accepted by the investment community, It was a technology company and was building communities on the internet and that what was the potential, theglobe closed up 606% on its first day of trading, not before doing a high of $97.00 (up 854%) before closing down at $63.50 from an initial price was $9.00. Welcome to the new economy.

The term new economy came about due to the strong economic growth the US had experienced and was doing so without inflation, American Stock markets had gained approx 20% year on year since early 90’s and wealth was been created as never before, this was something new and against the basic principles of economics and a totally different environment.

Companies were setting up shops on the Internet from where they could service clients from anywhere. Reach anywhere, sell everywhere was the way going forward.

Huge corporations were creating business-2-business exchanges where they could save millions if not billions of dollars by eroding away inefficiencies in the marketplace and integration of business processes and supply chains managements helped them achieve this.

Financial brokers accepted trading instructions via the Internet and offered tools to traders and investors alike in managing their own monies. Clients were now trading directly on most exchanges at the lowest commission rates and with greatest transparencies.

Overall value was derived by the lowered cost of doing business and the boost in efficiency by the deployment of new technologies, supply chain software’s and integration ensured companies were connected and were able to make efficient use of their information.

It was an excellent environment for starting up a company and wealth creation was at its peak. Media companies such as CNBC and others ran reports of how technology was changing the way business was conducted and carried wealth watch reports on individuals who were richer by a billion dollars within a year.

It was a ride of hope for everyone and fear for the old economy, who feared a takeover by technology companies which could eventually make them extinct since they were slow to adapt to such dynamic changes at a speed well beyond their capabilities. Which in all sense meant more profits for technology companies as selling of their products meant more profits with ease.

The most single important thing demonstrated by the listing of the theglobe.com was the appetite of hungry investors for tech stocks, such an appetite that was not going to cool down anytime soon, everything paled in comparison as history showed Technology stocks offered returns far greater then traditional companies.

Day traders loved them for the volatility, individual investors found them interesting and the future in them and companies who were slow to build acquired them for the value they had missed to build themselves.

Merchant bankers were quick to recognize this fact and actively marketed their services and fed the public with just that, more tech companies with the potential of huge growth and profits. Which also meant huge revenues for themselves and greater returns on unsold positions. It was normal for companies to gain a minimum of 100% or more on their first days of public trading, anything less and it meant some thing had gone wrong.

Valuation was the name of the game and the objective was to ensure higher rounds of valuation, from seed stage to IPO there was ample capital available, typically seed rounds went at a few million dollars and future investment rounds such as the 3rd or 4th went for a few hundred million upon which the merchant bankers would step in and make arrangements to offer stock to the public and public listing valuations were based on what a similar company had achieved and how greater the potential was in future earnings.

With the Internet growing steadily and doubling in size every couple of months, it was not difficult to imagine, a substantial growing consumers base that businesses could sell to and cases of revenue projections were based on (traffic) advertisements banners, products and services that could be sold to this group.

While all this was happening most of the world couldn’t really grasp the phenomenon behind such higher valuations, nor could they understand what was driving the growth behind this sector but one thing was certain. Valuations were headed higher.

Stocks just as America Online, Yahoo and Amazon had already reached high valuation levels which was hard to justify using traditional approaches, but since no one knew what was their real value, a whole lot of investors had lost out ‘big time” on such opportunities.

With companies like Microsoft making Bill Gates as the single richest man in the world, there’s was no sign of the bull ride stopping soon, but still there was too much disbelief that it would end in a big crash and this was just 1998.

Disbelieve from Politicians, media, and hesitation by investors who followed value based investment strategies, questioned on how could a company stock appreciate and continue to rise when the company has not even made a single dollar in revenues and will continue losing money.

All looked well, but in reality things were actually quite difficult everywhere else, Asia was in trouble and recovering from the 1997 Asian Crisis, Russian financial markets had collapsed and Latin America was facing a lethal currency crisis.

The only problem was, the world needed an economic engine, which the US provided, it was a gigantic economic powerhouse with the combined power of Asia, Europe and Japan and is still is, the single biggest gainer in the new economy creating technology and exports it to the rest of the world.

The US blessed with a strong domestic market soaked up the excess supplies of the rest of the world. Goods from China, Japan, Eastern Europe and other parts of the world were making their way into the American markets and America kept on buying and provided that engine.

In the last two decades many countries has jumped into the capitalist bandwagon and were producing goods in excess capabilities in order to turn their economies around and while all this pointed to a deflationary effect everywhere else, in the US it figured as if there was no inflation while they still had growth.

It was a great time for everyone and but it would be nearing its end soon, as its said on the street “the markets will convince all before it turns, the smell of greed is most at tops and fear at bottoms”. There were yet too many disbelievers of the new economy for the market to break so soon.

The turning point came in October 1998, When two noble price winners Mylon Scholes and Robert Merton and an ex Solomon brothers super trader John Meriwether were managing a fund called Long Term Capital Management.

Long term capital management was a hedge fund who arbitraged trading opportunities in Russian and Asian bonds and its trading strategy and model had just gone badly wrong, the problem was the fund was sizable enough to take down Wall Street with it, losses to the tune of 300 billion dollars were now been declared.

Questions were raised on Hedge funds regulations and how such a fund so sizable was allowed to operate. If liquidations were to take place of such a huge portfolio, it had the potential to take down Wall Street with it and create yet another huge financial disaster.

This is what the Federal Reserve feared most and they had to avert this for now as it was too early, Asia and Japan were yet to recover, Europe didn’t show signs of providing that global engine and most important of all, Y2K millennium fears were fast approaching whose effects on the global economy were yet unknown.

Long Term Capital Management was in long-term trouble and a panic followed on the markets. LTCM main problem was caused as Russia had devalued the Rouble and declared a moratorium on future debt repayments, this lead to deterioration of credit worthiness of many emerging market bonds and increases in spreads, Which LTCM had bet against.

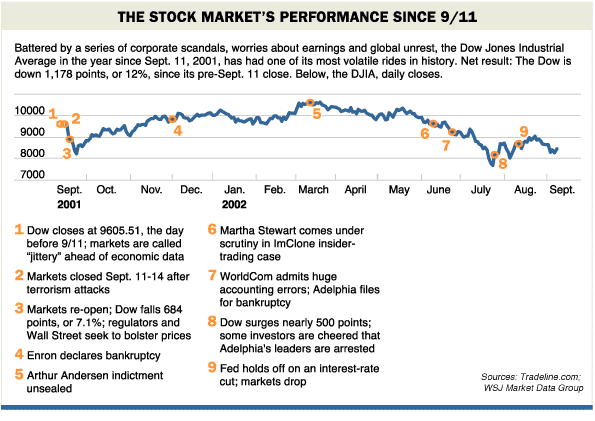

Most markets around the world plunged following Wall Street. With the SP500 and Dow Jones off by almost 22% in a few days. It was chaotic and scary and looked like the end of the world is near. Disbelievers cheered and re-iterated their claims that indeed the US was a huge asset bubble ready to be burst and they had given ample warnings, which no one had given attention to and all this could have been avoided.

To their surprise, the Feds kept the market tuned to their upside, it was yet to early for the timing of a financial collapse and the federal reserve moved and created a rescue package to bail out LTCM. Banks were instructed by the Feds to give LTCM more money in exchange for equity into the bankrupt fund.

In addition the Federal Reserve cut interest rates aggressively to ensure the rescue package created for LTCM had its desired effect and the markets turned.

It was a victory for buy and hold strategist and optimist of the markets and they called it the New Economy. Stories were abound of people who had become rich buying on every downturn and this time around were no different.

All this boosted investor confidence even further and the Feds was looked upon as a savoir in the markets who wouldn’t just let the markets collapse as wealth is been created and distributed at all levels within the economy.

The Feds simply didn’t want to create two much of a financial stress as the millennium fears (Y2K) were indeed for real and any major financial disruptions had to be delayed for now.

The single most importance of the LTCM effect was the confidence boost and the trust in the markets, everyone investors, businesses, workers and consumers were all pleased with the wealth effect, why disrupt the party? Which had just began and was on its final path to the upside.

Something else spectacular was happening, the Nasdaq would now gain 400 percent in the next couple of months and euphoria had begun.

LTCM Bailout, Market bottoms and huge rally, the greedy george soros also turns long.

Greed was taking over. Such greed that there was adamant confidence and trust in the markets which would continue even after the market had collapsed.

Traditional investing was out, in was new investing, day traders would gather in chat rooms and trade over rumors. Street café’s were specifically set-up to provide traders with trading information and execution access, where they would gather everyday to work but on their own monies.

New electronic communication networks (ECN’s) were set up to provide traders with the much-required liquidity, which lacked in technology and Nasdaq stocks.

Fears of competition from ECN’s made stock exchanges to relax their rules at all levels, listing requirements were eased and secondary exchanges started to spring up everywhere.

From Tokyo to Israel stock exchanges allowed new tech start up’s to list and raise capital from the public with ease, no previous revenue track records were required for new companies but they had to be in technology.

For the exchanges they wanted to compete with the Nasdaq, which was famous for technology companies and was the favorite among all others, Investor appetite was greater and start-ups could get the best valuations, which these new exchanges lacked.

This was the new economy, yearly growth no inflation and success was determined by investors for their companies that had achieved IPO status.

Money was everywhere. Companies with no prior records of managing funds in private equity were calling themselves Venture Capitalists. One such story was of a fund manager who after losing massive amounts of money during the Asian crisis decided to take a holiday in the Caribbean, once there he noticed young 20 something individuals flying in with their own jets and having a great time. This bothered him and he asked one of them what do you do?

The answer he got is “we are technopreneurs and we are rich because our company got listed, but this is nothing you should see our financiers”. The fund manager quickly cut his holiday short and returned to Hong Kong, once there he raised 50 million dollars and started up his own venture capital company.

It was later known that this venture capital firm had hit a home run and his original 50 million had turned into a billion dollars in about 12 months time.

Such were the days, where Venture capitalists and Angel investors went around sourcing deals in private equity and on the other hand raised cash themselves either thru a back door listing or from high net worth individuals.

Also joining in were Stock traders who made handsome profits purchasing stock at listing prices and re-selling later on, soon realized there is much more to gain if they were able to get closer to the value chain themselves and began sourcing deals in very early stage companies themselves

The criteria was simple, the company had to be a technology idea and have some commercial viability, most important of all the companies management had to have their eyes on an IPO and to fulfill these objectives, funds were provided to them to build, conduct R&D and ready till the stage until where a venture capitalist would come in at.

Founders everywhere started to quit their stable jobs and set out to set up their own Internet empires and it was perfect. Good news followed and the media reported.

Elsewhere established larger companies like Microsoft, AOL and YAHOO were already fighting battles among themselves trying to emerge as market leaders in the Internet community space. The idea was simple; one who owned the community had a massive competitive advantage to market to those consumers.

A space where Microsoft was weak in, with its existing monopoly in the desktop and personal pc market, Microsoft soon realized potential pitfalls the Internet had brought about for them and needed to scale up fast in building its web community platform.

The threat for Microsoft came from companies like AOL who had a ready pool of consumers through its ISP service made Microsoft to search for solution.

Just about that time, Hotmail was actively building their reach, the web first free web based email service had amassed a huge client base by providing free email service to individuals in India, China, USA and practically around the world.

Individuals who couldn’t afford a personal computer or who found difficulty in getting their own email services from their ISP, looked upon hotmail as the new medium to connect with friends, families and associates across the globe at practically no cost.

Email been the most popular communication platform on the Internet provided Hotmail with a strength and scale to deploy viral marketing techniques to build up their user base. Hotmail would just keep on growing as users were advertising on behalf of Hotmail every time they send an email to their friends and associates. With 9 million established users, Hotmail became a target for acquisition by Microsoft, who originally offered 150 million dollars for the two year old start-up, which Hotmail management team refuse, eventually four months later in December 1997 Microsoft paid Four hundred million dollars for Hotmail.

The initial four founders of Hotmail became very rich in identifying this opportunity and capital provided by Menlo Ventures and Draper Fisher Jurvetson (venture firms) had scored a big home run in a game of merger and acquisitions that had only just began. Total investments in Hotmail is estimated to be less than 15 million, with Hotmail going for it’s forth round of investments raising 3 million in just April 1997.

For the venture capitalist that had been approached by the hotmail team for investments earlier on, had now seen the light and it created a feeling of unhappiness for them. Not been able to identify an opportunity knocking on your doors is a big miss, which very few individuals will ever forget. Since then everything on the Internet with the word first mover became first mover’s advantage.

Valuations in the stock market continued to the upside and this gave public listed companies the currency they needed to purchase brands, concepts, competitors, and even expand and develop new markets.

The community building spree continued and everyone out there wanted a piece of action in the community space, more deals followed. AOL cut deals with Bell Atlantic, purchased Netscape for 4.2 billion and this spilled towards other ISP’s who wanted to fight off competition did the same, (AT) @Home another ISP moved to acquire Excite for 6.7 billion and Geocities a company that provided free web pages for community was acquired by Yahoo in a stock deal worth 3.56 billion.

In a buying spree, the public loved technology stocks for their upside and the promise of the new economy, it was normal for firms to double or triple in prices on first days of trading.

Everyone in essence was getting richer. Real wealth was been created and distributed all levels. The Feds to a certain level ensued all things been equal the show must go on. Japan was still in trouble and if the global engine stops we all might get into a deep recession.

By Mid 1999, the frenzy just caught on further and everything related to technology was hot. The most important effect felt in the economy were the changes in the media, who till now reported on a bubble collapse in the US, were now providing a basis for the new world, economy and changes made by technopreneurs.

They ran articles of successful technopreneurs, covered events and even set up their own Internet ventures. They talked about technopreneurs who were making a difference, technopreneurs who willing to risk all for pursuing their dreams and fulfilling their visions.

Technopreneurs Who could access capital, turn their ideas into reality and list on the markets, turning original millions of investor’s money into probably billions, all in a matter of a six months.

The media had turned from being bearish to extremely bullish on technology all within a matter of six months and the markets loved that, merchant’s bankers praised them and sold more stock.

Governments everywhere were threatened by the these new corporations as they were been build, they were big fast and moved quickly, their eyes opened up to the billionaires been created in the west and they wanted a piece of the internet action, they called it knowledge based economy and created special IT trade zones which allocated vast amounts of national resources to start-ups for a promise of putting these countries on the world software map.

Old economy rules were thrown out and new policies were put in place to accommodate technopreneurs, bankruptcy was now considered hip and in order to facilitate adventurers to come again and take a shot at the business world once again, Bankruptcies laws were amended, allowing previous bankrupt individuals to reclaim their credit in society and start all over again. In some countries they even presented an award to individuals who were once bankrupt and had fought back against all odds to become successful once again.

This was truly one of the best times in history to setup a company and venture and this is what happened, New 18 year olds were setting up companies and were looked upon on as becoming the next the bill gates, corporate mission statements read, “we like building companies and have fun in doing so and traditional bankers went to office in t-shirts instead of the traditional suit and tie’s.

Company’s success was determined by how many investors they had and higher burn rates were considered growth, capital promised growth in market share and there was plenty.

Venture capitalist ignored the fact and demanded market share and exposure while sacrificing revenues and their targets. Been profitable was not in fashion and growing big fast was the way going forward. They wanted start-ups who could scale and become industry leaders and the start-ups let them hear just that.

The money flowed back into the economy and everything with dot COM was hot, not a single day could pass without one been bombarded via big billboards, colorful busses and TV advertisements shouting out DOT COM.

Suppliers wanted them for their cash, employees looked upon them for success and investors wanted their equity which was worth more then gold and were willing to trade for them with services.

Landlords offered free rentals, lawyers, accountants offered their services and practically everything could be purchased with a option of a private equity, traditional media giants picked up equity in companies in exchange of free air time and prime time advertisement spots.

The logic was simple for investors, “I know the price I am paying is absurdly high, but somewhere out there is a greater fool than I am who will, when the time comes will pay an even higher price” The tech bubble doesn’t burst until the greatest fool of all has brought” they said.

For start-ups it was even simpler, the market was singing their tunes. Every day was party time, either a networking session event or a posh new dot com launch would be held, investors would come around as gullible as they were, looking to meet some promising start up’s to give them their hard earned money.

We were approaching the year end and fears of y2k had subside as money could take care of everything and there was too much of it around, new IT spending boom prevailed and billions of dollars was spend in upgrading of IT networks to ensure trouble free transition into the millennium. This added fuel to the lofty prices of the stock valuations.

Optimism was highest at all stages and so was greed. Practically every traditional company now had their own venture arm for investments into start-ups and for those who were lesser financed and had existing inventories and resources to trade set up their own incubation center’s all for the share in private equity of a dot com.

Non tech related companies began to realized the value behind the dot COM name and started branding themselves by adding a net or com to their businesses, with ease of listing for new tech companies, loss making companies, factories, manufactures, and property developers who were in dire straits and in need of capital could now secure financing through listing on these new tech markets and were partially exiting their positions while the gullible investor wanted more.

Elsewhere companies were losing talent to start-up companies, bright individuals with good careers were quitting their companies for a punt at the Internet world and the media sang glory of technopreneurs who were making a difference.

Universities and IT training centers followed the boom and starting educating individuals in technology, as it was hot and there was a huge demand for people who could build and manage technology for non tech savvy companies.

In countries like India billboards read “ 25000 programmers needed in USA, Germany and Singapore. Confirmed Jobs, Six Months training and everywhere else it was no different.

The Schools, universities and training centers started to offer courses in e-commerce, dot.com, technopreneurship and the likes. They were churning out individuals by the thousands and the Americans were employing them.

Manpower services companies were set up to facility this trade, which is no greater then the body shopping business but there was demand and someone had to do this job.

With rigid laws for employment and a constant shift in technology focus, most companies didn’t want to employ full time staff and opted for a contract with the manpower services companies to hire people from them on contractual or project basis, they paid good money for each individual sometimes far exceeding the salaries of local staff which were hard to find and again for companies who didn’t want long term liabilities this offered a perfect solution.

This contributed the basis for revenues for most Indian listed technology companies who instead of building software solutions were nothing more but a manpower services company, expected gain on each staff contracted sometimes exceeded a couple of thousand dollars each month and the idea was simple the more people I ship the more money is there to be made. On Average four to five thousand programmers were shipped monthly if you multiply that with a two thousand dollars each, you get a very nice number for revenues, which could also make up a very nice case for a public listing process.

In other areas in India a software solutions firm at one time with a revenue base of 150M gained a market capitalization of 34 billion dollars as they were one of the few software companies from India listed on the Nasdaq and as most fund managers who follow herd instincts found this company as the only one with huge value in them.

As most old economy companies made the plunge into technology they lacked expertise in this space, then came along technical executives who could assist them in achieving those corporate goals, prices escalated further and so did salaries but this time the companies had to also part with options into the new company.

One particular incident worth mentioning is the IPO listing of a company out of Hong Kong called TOM.com, TOM.com was conceived by Mr Li Ka Shing, the richest man in Hong Kong with previous businesses in construction, real estate, utilities and telecommunications, there was something lacking, no dot.com, so Mr Li conceived an idea to create his own multimedia empire and tom.com would be it.Such was the euphoria that thousands of investors woke up as early as 5.00 AM to queue up outside of a bank for application forms for the initial public offering of shares in tom.com, which was a subsidiary of Cheung Kong Holdings Ltd. and Hutchison Whampoa Ltd both Mr Li’s companies. Tom.com was listed in Feb 2000; the estimated public float was US$1.47 Billion. According to Hong Kong police some three hundred thousand people had joined the queue.

The greedy come out in crowds, all wanting a piece of the action, just near the top. An estimated 300 thousand people lined up since early morning. Tom.com IPO

Elsewhere in Malaysia the government build up a whole new colony for technology companies and called it Multimedia Super Corridor and offered first class facilities for technopreneurs, besides these other benefits included Venture capital, 10 years of tax holidays and a chance for these companies to bid for government related contracts.

Everyone wanted to duplicate silicon valley and they attributed the success of America upon ready available capital and the risk averse entrepreneurs needed to innovate.

Disbelievers of the new economy were one by one convinced by the new economy and by March 2000, everyone who had not joined the rally to the upside was on the bandwagon.

Funds, who bet against technology, started investing in them and changed their strategies. Tiger Fund, Warren Buffet and George Soros all previous disbelievers now had investments in them and were now bullish on the future then ever. To them it just didn’t make any sense, but when you are wrong you can’t hang on for long.

By now most pension funds which were supposed to ensure livelihood of many individuals in their golden years were invested in technology, Universities, Private trusts, hedge and mutual funds were punting on them and in fact the US government was also considering parting with its citizens social securities funds to get a piece of the technology action.

It was these chains of events and timing that outlined a near term collapse.

Between 1999 and March 2000 most bearish funds made record purchases of technology stocks and the Nasdaq 100 was now 400% up from its LTCM lows.

And the media, behind the curve, on hindsight tried to make sense of everything.

There were more bullish books on the subject of investing then any other time, two books in particular worth mentioning were released which outlined continued market growth “Dow Jones to hit 36000 and 40000 respectively” and famous author of liar’s poker Michael Louis released the New New thing where he writes about new internet billionaire Jim Clark, the founder of Silicon Graphics and Netscape and who was going to turn health care on its ear by launching Healtheon, which would bring the vast majority of the industry’s transactions online, After coming up with the basic idea for Healtheon, securing the initial seed money, and hiring the people to make it happen, Clark concentrated on the building of Hyperion, a sailboat with a 197-foot mast, whose functions are controlled by 25 SGI workstations (a boat that, if he wanted to, Clark could log onto and steer–from anywhere in the world).

It was the timing again of Michaels story, whose previous book coincided with the bond market collapse of the eighties where he describes the height of the junk bond craze and the atmosphere of competitiveness and the vast rewards everyone was reaping as a result of that boom.

Greed had taken over.

On April 3rd 2000, the Nasdaq broke down. But this was not before establishing a high of 4816 on March 24 2000. A gain of close to 500% from its LTCM lows.

And the once poster child for the rise of the Internet Bubble Theglobe plunged to a low of 19 cents, a staggering 99.8 percent from the company’s all-time high of $97, which it reached on its first day of trading and was given the de-listing notice by Nasdaq for failing to recover to the required $1 minimum bid price. It currently trades on the OTC- Bulletin Board (Feb 2001)

Technopreneurship – The Successful Entrepreneur in the New Economy – Daniel Mankani. Published 2003. Pearson Education Asia – All rights, copyright reserved Daniel Mankani { ISBN0-13-046545-3 }

Chapter The Greed >>> Technopreneurship-The Successful Entrepreneur In The New Economy.

LINKS

Disclaimer. http://ul3.com/L30qH

Back to the Beginning. http://ul3.com/aeVUG

BTAMSC – http://ul3.com/vAqdH

The Greed: http://ul3.com/pUDgd

The Ignorant, Zombies: http://ul3.com/PP8Ez

History: http://ul3.com/1rCFA

Chart Patterns: http://ul3.com/54VLV

Introduction to Technical Analysis. http://ul3.com/kcYCE

Writings.

INTRODUCTION TO FINANCIAL MARKETS & TRADING OPPORTUNITIES IN COMMODITY, CURRENCY, & FINANCIAL FUTURES. http://ul3.com/dAFWj

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

– Global Economic Collapse January 18, 2016

And Why;

Technopreneurship Development – Daniel Mankani. http://ul3.com/kcYCE

– Published Sep 2003. Pearson Education Asia

In 1875, with a contract from Western Union, Edison began work on the acoustic telegraph, which used tuning forks to send telegraphic messages at different frequencies at the same time. He would use this money to build Menlo Park. From this work on acoustic telegraphy, which he pursued at the same time as Alexander Graham Bell, came the telephone, which relied on Edison’s research, and the phonograph, which was inspired by the potential to replicate the sounds of acoustic telegraphy.

In 1875, with a contract from Western Union, Edison began work on the acoustic telegraph, which used tuning forks to send telegraphic messages at different frequencies at the same time. He would use this money to build Menlo Park. From this work on acoustic telegraphy, which he pursued at the same time as Alexander Graham Bell, came the telephone, which relied on Edison’s research, and the phonograph, which was inspired by the potential to replicate the sounds of acoustic telegraphy. Innovation can be classified as Breakthrough, Incremental, Game Changing and Disruptive.

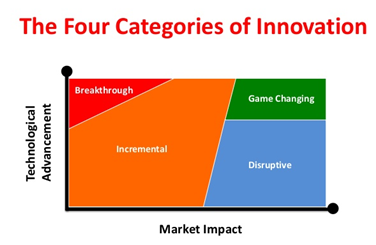

Innovation can be classified as Breakthrough, Incremental, Game Changing and Disruptive.