11-May-2019/Dynamictrader.com; The effected result of the New Tariffs imposed on China is expected to result in further squeezing of the American Consumer which by some expectations could result in up to US$800/- per family in America with PMI, Economy and Employment suffering going ahead and with the brunt of it to hit on the consumer.

The Financial markets on the other hand have not only reversed all their losses and made new highs just two weeks prior and going into the FOMC, Trump’s tweets further reimposes the idea that indeed to counter the ill effects of his own trade policies China is stimulating their country and mighty America ought to do the same.

These two tweets spread around like Snapwire hot off the press, Signalling the party is about to start like wildfire.

If Indeed this is the case, it would need a move down to at least 10% off current highs to make it convenient for Powell to follow up on Trump’s monetary policy tactic of even further loose monetary policy and to go by any recent evidence, its exactly what China just did after the new tariffs had taken the wind out of its economic sails, They too went up like a Rocket!.

The last time such a scenario presented itself was in the Summer of October 1998, when our regular bouts of Bailouts first began and the stock market party like no tomorrow, Here is what happened then.

President Trump logic is relative simple, We print money big big, debt becomes small, poverty is uplifted. Debt is a cause of poverty, when you are unable to keep most of what you ever make, much akin like taxes, and if the government takes more like now in the case of tariffs, no matter what consumption suffers. Lets Print new values and isn’t it how we fix things for the better part of the last century.

And maybe just maybe that is what indeed the world economy needs, a mechanism to inflate the outstanding load of debt away, with more money in circulation, inflation gets back, eroding money value by a regular consistent percentage and with that higher incomes to compensate for a relative stable debt load that deflates while money inflates at the same time.

Whilst these higher values in higher cost paid and higher incomes received will result in enhanced GDP figures and in turn make debt ratios looking relatively smaller and may give a boost to the global economy which is stagnating and quickening at the same time. Some options mapped out by Merrill Lynch;

So what will it take to get us there.

We all know the federal reserve and all central banks will panic once the market turns down 10%, last December that’s exactly when Powell turned dovish and two months prior the Federal Reserve was tapering, today there is no greater evidence to prove Central Banks policy is not data driven nor it is independent, it is geared towards perception management and the stock market is hardly reflective of the underlying conditions of the real economy on the ground, but nevertheless they try.

So like in the summer of 1998, when the LTCM collapse came and in the same summer were legendary traders like Neiderhoffer went bankrupt and Veteran Trader George Soros went short into the dot com rally before losing 60% of his bet and going long near the highs. The Party like 1998 is about to start, we just need a systematic collapse and never let a crisis go to waste.

What are the leading thoughts of China in all of this….

The last time such a scenario presented itself was in the Summer of October 1998, when our regular bouts of bailouts first began and the stock market party like no tomorrow began, The Stock market made higher highs with the Nasdaq rallying in over 500% in 16 months from the LTCM lows and a party like no tomorrow had begun, which wouldn’t turn till the greatest fool of all had gone long. Here is how it happened back then.

How we just screwed the consumer, each family to be affected by 800/- dollars per year by Trumps trariffs on China, this last Friday. 10th May 2019.

Further Reading

{cognitive dissonance} Animal Spirits, Bubbles, Mania’s and Market Peaks. http://ul3.com/FIl46

{cognitive dissonance} FOMO Signs of the Euphoric. The Bust is almost near! http://ul3.com/6K2S3

{cognitive dissonance} BITCOIN – A Fraud and Ponzi in a Disillusioned World: http://ul3.com/35fH1

{cognitive dissonance} The Greed: http://ul3.com/pUDgd

The Hope: http://ul3.com/CuC7d

{cognitive dissonance} The Ignorant, Zombies: http://ul3.com/PP8Ez

{cognitive dissonance} Perception vs Reality: http://ul3.com/UcYb1

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

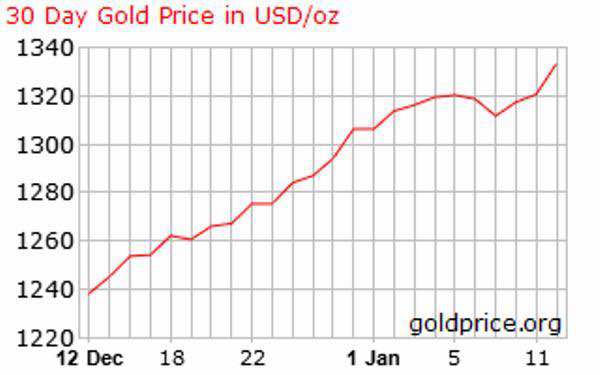

– Global Economic Collapse January 18, 2016