Technopreneurship – The Successful Entrepreneur in the New Economy – Daniel Mankani

{Reprinted with permission “Technopreneurship – The Successful Entrepreneur In the New Economy” – by Author Daniel Mankani, to purchase this book, proceed to amazon.}

A Role for Society in Technopreneurship Development, a chapter written in 2002, explains the creative destructive forces at work in practically every aspect of human life and the reasoning for the massive confusion, leading up to revolutions, lack of employment opportunities and governments fiscal deficits. Technology is usually blamed for making the world a smaller place, the writing was on the wall since the late nineties, this chapter refreshes our memories.

Daniel Mankani is the founding CEO of BTAMSC and drives strategic decisions of the company, currently he is writing, “Knowledge Based Economy, Its Evolution, Not Revolution, the new prelude should update Technopreneurship-The Successful Entrepreneur in the New Economy, an often quoted text book, part of universities diploma/degree syllabus on technopreneurship courses.

To download PDF version of this chapter, click here.

A Role for Society in Technopreneurship Development

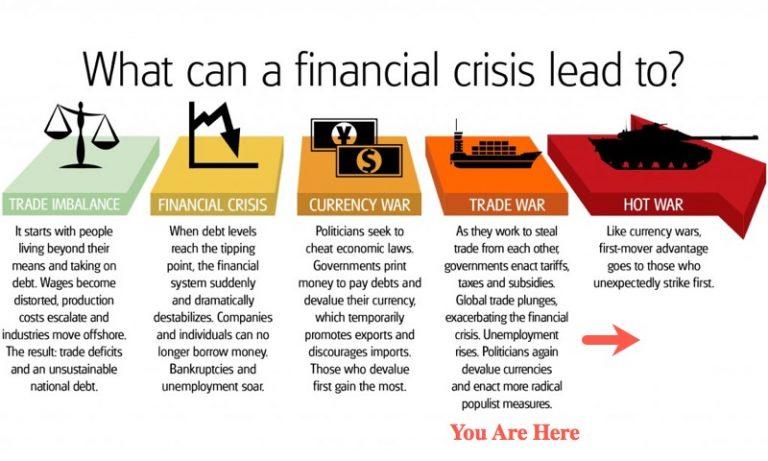

The economies of industries are already in a grave recession, the addition of the information economy has further diluted its potential value and the collapse of the NASDAQ has in essence killed all consumers and businesses growth potential.

Today, we stand at important crossroads, the hope is for information technology to address the inefficiencies that are visible in today’s marketplace and provide us with a platform to jumpstart and revive the global economy.

The NASDAQ collapse was a boon in disguise, it showed us the importance of value and reminded us about the rallies of greed and their sustainability, the only regret we have today is the rally should have been checked and shouldn’t have got out of hand.

In this process, the move to the upside on world markets made us to forget the basis of economic growth, made us to think we are invincible and made us to build up huge layers of inefficiencies, debt and excesses in the system, which we are now fighting hard to correct.

Today, we have more of everything, we have more food on the face of the planet, we have more technology then we can use, we have more houses then people can be sheltered and all that we lack is market driven demand to soak them up

On the other hand, the involvement of Eastern Europe, China, India and a dozen of other countries in the capitalist markets in the last two decades is not helping us either, all of these countries are churning and dumping goods and services on the world markets faster than any demand we could build up, this in essence has then contributed to a disastrous dilution effect, which is of little value as it destroys wealth.

In turn, the dilution era has effected consumers and businesses spending patterns and they have tighten their belts and have developed a wait and see attitude towards prices, with the rationale, why buy now? When tomorrow goods are only going to get cheaper? The tomorrow they look forward to may never materialize as the days thereafter prices are expected to head even lower.

The old routes of economic growth and prosperity have also been increasingly blocked, the earlier days economic model which once seemed rock solid do not function anymore, the export oriented growth model, which most Asian countries implemented are now in doubt and the once successful Japanese model has faltered and all this is very disturbing.

What we are experiencing is the collapse of all demand as we know it and this has affected practically every business, with businesses in trouble then the question is, who is going to employ our workers, who is going to pay those taxes and how are we going to keep the engines of the economy humming along fine.

The answer may just be in front of our eyes. TECHNOPRENEURS> we need more of the technopreneur to build world-class companies. We need technopreneurs to build solutions that will spur growth and demand so excesses can be soaked up with ease and we need technopreneurs to build up the information economy whose value will benefit the economies of industries the world over.

In a speech on “Structural Change in the New Economy”, delivered to the National Governors Association on July 11 2000, Federal Reserve Chairman Allan Greenspan argues, “it is the proliferation of information technology throughout the economy that makes the current period appear so different from preceding decades.”

He continues by mentioning ’“One result of the more-rapid pace of IT innovation has been a visible acceleration of the process that noted economist Joseph Schumpeter many years ago termed ‘creative destruction’—the continuous shift in which emerging technologies push out the old.” Among the advantages of the New Economy is the ability of corporations to generate a flood of information in mini- seconds, allowing them to “reduce unnecessary inventory and dispense with labor and capital redundancies.”

He highlights to us, the speed and efficiency of the integrated supply chain in the new economy and its greatness whose effects can be felt not in the matter of months of years but within days of major economic shifts throughout the whole system, and it’s this efficiency that in turn pinches the man on the street, who controls the majority of all spending and capital.

Another key point the Fed Chairman highlighted was the manner in which the supply chain had been integrated at all levels within the economy, he points out that it’s this efficient supply chain in the global economy that removes the redundancies in the marketplace, if so then this also means majority of the world population are been weeded out and are becoming obsolete.

In all respects these have seen the markets becoming transparent than ever before, the consumer is more demanding than ever before and competition today is so fierce than ever before.

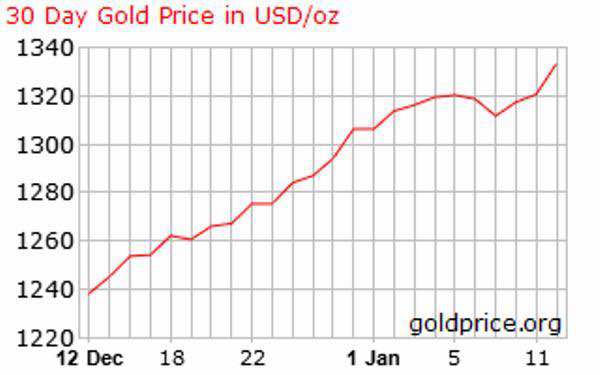

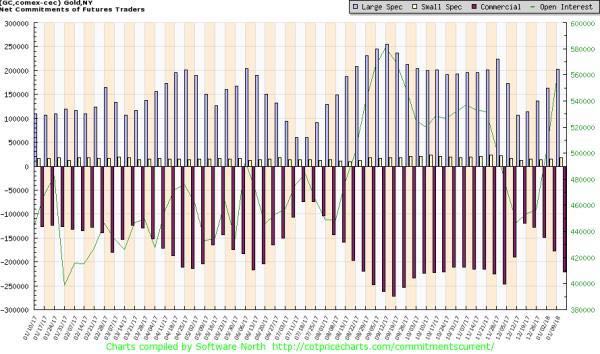

The effects of globalization and the dynamic movements of capital are greater than ever before and the effects, sentiments of the global financial markets are having a greater impact on economies than ever before.

These are in essence some of the challenges for countries and their respective governments for they are wondering how they could retain human capital and their intellectual contribution for a better tomorrow.

They are wondering how they could lead their people out of the economic adversity for the economies of industries and demands have collapsed. For they have to understand that it’s the technopreneur who develops innovation and that attracts capital and it’s him who holds the key of our economic prosperity for tomorrow.

As society we have a major role to play to assist in the technopreneur’s development and that of technopreneurship, we have to create a cohesive environment, where innovation can be breed, tested and where capital can be assessed so that the technopreneur of today can be market leaders of tomorrow.

We have to encouraging, forgiving towards their deeds and caring towards their needs for they we are breeding leaders who have will command market share and determine how we compete on an International level.

For capital is global and it’s the single most denominating factor that affects our lives, our assets and therefore our future generations and it’s this capital that is attracted to the technopreneur and his world-class company.

It’s the technopreneur’s world class company in our local stock markets that attracts capital and it’s this capital whose movements are swift and are a performance indicator of our underlying economy, increasingly this capital and technology that used to pour in from the first world is also slowing, causing forecasters to systematically downgrade all of our future economic prospects.

With the old foundations of success gone, Technopreneurs, research and development programs, creative capital, and responsible information technology incubating institutions are quickly replacing and building the economic growth foundations for the twenty first century.

We as society, have to ensure we have proper educational processes in homes, schools and universities, if we are to breed technopreneurs, as parents we have to teach them to be giving, responsible, reasonable and allow them in the freedom to express themselves, allow them to destroy the old in creation of the new and most importantly we have to teach them the power of knowledge and how to be able to harness it.

At schools we have to teach them subjects of science instead of politics, we have to show them books of mathematics instead of geography and we have to hold the creators of innovations high, instead of those who capitalize on them.

At universities we have to lead them to the problems and provide them with a foundation in addressing them and not solve problems, which do not exist. We have to teach them the importance of efficiency and the drive behind market demands.

Our professors have to be learned but learned from experience instead of books themselves, because they are good for reference and history, but are static, we need the dynamism and the learned to teach them the joys, pains, prerequisites of a startup cycle and impart to them strategies of management, business and creative destruction.

Our employers have to work harder and weed out any signs of negativity, since productivity, efficiency and creativity directly suffers from them. Our employers have to impart to them stories of persistence and success of the old economy and teach them the importance of teamwork and corporate culture.

For we want to breed visionaries who we want to command and rule the world, cause these are the visionaries, who will capitalize on the great opportunity created by globalization and the Internet.

In the 21st century the recipe for success is knowledge based, not resource based and for those who recognize this, knowledge is the new basis of wealth.

Such is the new wealth that it’s powerful and movable for it can make a country success and while taking the away the success from another. As a society our protection is the buildup and distribution of this wealth for we need to create a system for those who want to access it.

For we need to build up facilities for research and development and creative capital to support them, we need our leaders of yesterday years to assist the leaders of tomorrow. We need our businesses to provide technopreneur’s with the platform for research, development and deployment, so that problems can be viewed, addressed and solutions developed, for they need businesses to recognize that if they are successful, collectively their success comes together.

Businesses need to understand, startups require creditability and require support on the local grounds before they can make way to the global levels, businesses need to understand that technology by itself is no competitive advantage and knowledge is never equal at all levels.

They need to understand that any solution delivered by any big institution has the same components as that of a startup’s offering and at times contracts awarded to big name companies may have been developed by a startup as part of a third party outsourcing agreement. They need to understand that brand name software doesn’t necessarily contain brand type value and lastly they need to understand that technopreneurs are among the best for the job, as they crave for your success more than the businesses themselves.

Businesses need to understand that technopreneurs are no threat to them, but are revolutionary’s implementing change necessary for our evolution, they are required to study the inefficiencies, implement the new and provide a basis for tomorrows growth, despite of this, businesses are still staffed with negativity which fear and that their end is near.

The negativity in the economy is so great, that everyone who accepts change expects risk and risk is what many cannot afford. Businesses need to change this or bring in fresh blood to create this cohesive environment, for the longer the delay. Longer will be its pain.

Businesses need to accept failure and respect those who have failed. One of the many complains that technopreneurs have today, is that they are not accepted back into society as they have failed, they are riddled and feared, and after all who would want to employ an ex-dot comer or a technopreneur that has done it all.

The technopreneur has figured out his income, raised capital, strategize his operations and most importantly has determined his own fate by dynamic adapting to the changes in the environment, on the other hand we have a manager who lives in the shelter of his employer and fears holdings the reins of change and accepting a technopreneur is accepting change.

Businesses need to figure all this out and if they have to creativity destroy the old chains of command and bring in the dynamic, motivated and enthusiastic fresh blood in the organization, theirs choice should very well be the technopreneur again.

For their fear that once the technopreneur has figured them out they will become obsolete, they need to realize if one’s value is lesser then their cost no matter which role they play, they will surely become obsolete.

For they need to understand that the technopreneurs asset is that of knowledge and knowledge is the new wealth, it’s intangible and movable. For they need to understand that never before have we leveraged on the value of knowledge and it was investments in knowledge and intellectual property that made the richest man in this world.

Never before have we seen the richness of knowledge and despite all this, we still see banks refusing to finance its worth and venture capital firms unable to gauge its worth.

For we need to build up the network from which capital can be assessed. Angels, banks and venture capital firms have important roles to play, as without the required capital, development and deployment is in question. While innovation and knowledge is the part of the mind, soul and passion, it requires capital as oxygen to function.

Banks today are still stuck in their glory days and with the dot com collapse they have turned so negative that liquidity has been squeezed from the system, they are still waiting for the hey days where there were millions of dollars requirements towards industry development. For their fail to understand that industrial activity is at a standstill and all that was required to be developed has already been developed.

They rather take the chances of pushing more credit cards in the hands of the consumer, for they think the consumer is safer. They fail to realize the potential of the knowledge based economy and fail to see the potential of the technopreneur.

They still ask for tangible assets for financing, failing to realize the technopreneurs assets are intangible, what is required of them is the need to build a valuation model for intellectual property that ensure their commercial viability, similar to the manner they do with real estate property, they should ask for patents and customer endorsements before they lend money.

It’s the same with venture capital companies, for they are staffed with ex-bankers who don’t really understand their own business and they don’t understand the business of the technopreneur. They want to see fool proof business plans and want sure win guarantee’s, for their fail to understand that it’s not the plan but the execution that counts and they need to know that execution has to be dynamic so as to determine its success.

They need to understand the investment and its larger opportunity and place their bets on the execution strategy and the team. They need to understand that deals that look very good are seldom the ones who are winners. They need to understand that the number of times they can place a bet, the lesser the risk of ruin and larger the probability of wins. For they are the venture capitalist and becoming a banker is where their failure lies.

It’s the same with Angels. For they want to invest and they want the best price and best bargain, they fail to understand the potential and they fail to understand a hundred percent of zero is zero and five percent of one hundred million is still five million, for most angels deals that have collapsed, the reason has always been equity distribution and valuation and finally when the angel did invest at his preferred rate he got his deal but he lost his money due to his greed.

Angels need to understand the viability of the project and the value the bring on the table, for their expertise is needed in early stages and its value is greater than money, If its pure capital and then the angel and the technopreneur should focus on the potential return instead of the size of holdings.

While all this is our recipe for the new economy, which is within our grasp, its execution is the key and its implementation is necessary. It requires consistency, sincerity and a multi facet strategy and who else but the local governments have the strengths to be the driving force for such implementation.

[1]As stated by International Advisor and Consultant, Dr Khalid Abdullah Tariq Al-Mansour, he says, Empty Sincerity, however noble, is no substitute for self-sacrificing, visionary, disciplined and committed political leadership. Relevant public and private education, in all its many challenging forms, must be continuous touted, reinvented and improved. In this regard, special stress must be placed upon “knowledge-based” science, math, logic and reason, technology, morality, engineering and creative strategic planning. In the process, every functional institution of society must be co-opted and given concrete, achievable assignments.

Dr Khalid comments are held in the highest regards and as an advisor to governments; he understands well what the governments have to do in order to turn around their respective economies. For it’s the government that hold the reins of economic growth and prosperity in their hands, it’s them who have to embark on a plan for technopreneurship development. For they are the ones who have to ensure there is adequate capital and resources available for the technopreneur.

For they have to understand that we are in a deflationary era and excess supply of money in the system today doesn’t have the same effects as during inflationary times, they have to ensure money supply is distributed at all levels within the system and draining money out of the system during economic fallouts will head us into a depression.

They have to understand that providing capital to venture companies is not enough, they have to ensure that the money is put into real ventures. They have to understand investments in development without the user base and acceptance of that development is of little value.

Lastly they have to understand they have to put their trust into technopreneurs who are the leaders of tomorrow, but before that as they are leaders themselves, they were once lead by another who showed them the ways.

/END

To buy the complete version of this book in print, please proceed to Amazon.com