Dynamictrader.com/24/12/2017/ Daniel Mankani

Animal Spirits is a late stage market event in which bubbles created by a herd mania in a collective illogical intuition {cognitive bias} culminating into market peaks and eventually its bust.

Animal Spirits.

There comes a time when rational thought takes a backstage and excessive risk-taking behaviour trumps, Alan Greenspan first referred to this as “Irrational Exuberance” in the 1970’s, although he may have got it wrong this first time around.

Today this has now become an important part for all students of Behavioural Finance.

For the most part, Humans are expected to be rational in the management of their affairs. They plan and coordinate their affairs to the best of their abilities for self-preservation and thereafter their goals are enhanced further for even better positive potentials and outcomes by the deployment of their self-capabilities.

This risk-taking behaviour is inherent in all of us. A parent takes the risk to provide for a baby, an entrepreneur does the same when he goes into business and A trader wages his bet based on his own statistical understandings with attempts to tweak outcomes to his advantage.

“Nothing infuriates a man more than the sight of other people making money.”

Yet, there comes a time when all rationality is lost. Driven by either fear or greed, intuition begins to drive decisions of oneself, which in itself is without any conscious reasoning and simply an output and/or recollection of cognitive bias.

With participants overestimating self-capabilities and potentials, a deviation from the norm occurs and rationality in judgement takes centre stage, whereby inferences from other people and situations are drawn upon in an illogical fashion.

Humans like Animals find safety in collective thoughts, a sense of stability prevails within the herd and like every herd headed to the slaughterhouse, the leader of the pack has to be in confirmation or else he loses his position as a leader, he is bounded by this collective thought and the pact follows him as a means to collective bias.

Animal Spirits is a late stage event that occurs in every market and in 1998 we documented the story of the Internet boom and its subsequent bust. It’s a very interesting read and demonstrates how irrational collective herd behaviour leads to the slaughterhouse.

Bubbles.

The Federal Reserve has consistently fed one bubble to another since the start of the millennium and just like in 1998 with the bailout of “Long-Term Capital Management”, resulting in the Nasdaq rallying from the lows near 1000 into 5000 all in a matter of fifteen months.

I know the price I am paying is absurdly high, but somewhere out there is a greater fool than I am. Who will when the time comes pay an even higher price.

This upturn was all that what was required to bring all the naysayers of the times into compliance and once the greatest fool of all has gone long, the market peaks and ends in tears for all those without rational thoughts, herds into the slaughterhouse.

More importantly what was missed out then and is valid even today is the times prior to the March 2000 Peak. The bust of “1997 Asian Financial Crisis” had very little positive economic growth, present were the depression-like conditions with negative GDP’s across the Asian region, elsewhere Russia was facing pressures on its sovereign debt and Europe was in the midst of adjustments welcoming the Euro.

All these culminated into capital and resources pouring into the “Technology Bubble” as a be it end all.

Bankers quit their jobs to join start-ups, Underutilized resources such as “Office Spaces” were offered to start-ups for a share of their equity, Companies added an “E” or “I” to their business names, everything technology related became a buy. Irrational Thought driven by Greed or Fear became prevalent all across the board. See the chapter Greed.

All those without any understanding of the inner workings of technology were now on board. Today its no different, there are Parallels in the economy, mathematical relationships and equations we can draw upon.

A bubble is created when irrational thought and outright stupidity are visible to the naked eye and yet it remains as a doubt not to be questioned due to the collective bias of the herd, while the herd in itself is together for the very same reason and illogical intuition drives human behaviour to confirm. Today we have bitcoin.

Manias

Most Market Mania’s have almost universally similar characteristics, Beginning with this time is different and easy money mentality. There is almost always no underlying valuation attributes or anchoring to any fundamentals. Early participants overestimating everything with overblown claims of growth stories and infuriating those who have yet to participate, a fear of missing out prevails greatly.

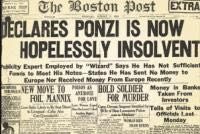

Then out of sudden a period of Irrational Exuberance prevails with a decline in credit standards leading many to borrow with Ponzi Financing fueling the bubble to unsustainable levels. In a self-fulfilling prophecy, higher prices bringing in even more participants leading to even higher prices, eventually surprising even the early participants, who then refuse to reinvest their Rich returns and proceeds. Finally culminating into the bubble bursting where the latecomers almost always end up holding the baby.

Further Reading.

Signs of the Euphoric. The Bust is almost near!

BITCOIN – A Fraud and Ponzi in a Disillusioned World

Technopreneurship – The Successful Entrepreneur in the New Economy – Daniel Mankani. Published 2003. Pearson Education Asia – All rights, copyright reserved Daniel Mankani { ISBN0-13-046545-3 }

Chapter The Greed >>> Technopreneurship-The Successful Entrepreneur In The New Economy.

LINKS

Disclaimer. http://ul3.com/L30qH

Back to the Beginning. http://ul3.com/aeVUG

BTAMSC – http://ul3.com/vAqdH

BITCOIN – A Fraud and Ponzi in a Disillusioned World: http://ul3.com/35fH1

The Greed: http://ul3.com/pUDgd

The Hope: http://ul3.com/CuC7d

The Ignorant, Zombies: http://ul3.com/PP8Ez

Perception vs Reality: http://ul3.com/UcYb1

History: http://ul3.com/1rCFA

Chart Patterns: http://ul3.com/ate6A

Introduction to Technical Analysis. http://ul3.com/kcYCE

Writings.

INTRODUCTION TO FINANCIAL MARKETS & TRADING OPPORTUNITIES IN COMMODITY, CURRENCY, & FINANCIAL FUTURES. http://ul3.com/dAFWj

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

– Global Economic Collapse January 18, 2016