The period of greed is ending and a sense of denial prevails.

Since the great financial crisis nothing much has changed, the excessive stimulus had two major effects, zombification of the economy and concentration of wealth in newer and fewer hands hence inequality.

Inequality is a consequence of those who could game the system versus those who couldn’t.

Zombification occurs when financial prudence takes a backseat and gives way to euphoric gun slinging behavior in the hope of what works past will always continue to do so and leads to even more of the same, essentially what this does is; it kills all demand as excessive capacity increases and utilization of the same suffers. The other affect out of this is capital seeking returns pile onto the very same processes which are high yielding, eventually destroying yields as supply increases and demand suffers.

Economic growth is not infinite and never can be. Boom and bust cycles are an inherent part of the capitalist economy just like in human’s nature, We tend to do what works till it stops working and we tend to avoid what doesn’t work and try something new.

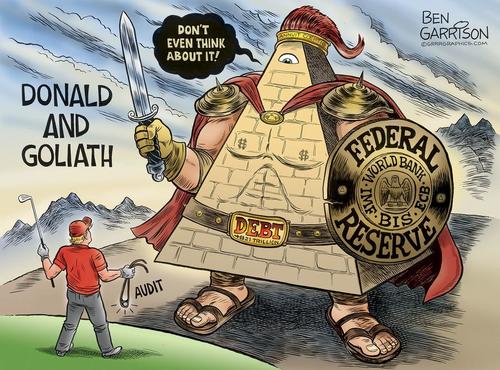

Economies across the world have now lost the last leg of growth, it started with cash for clunkers for the auto-sector, then lowering interest rates to the housing sector, student loans for enhanced education and corporate loans for stock buy backs and the Federal Reserve now says no more.

At the bottom of every cycle there is fear and we are far from it, hence looking for a bottom at these levels is futile.

Each and every cycle begins with greed and euphoria, by avoiding the corrective behavior of the last great financial crisis of 2008, market participants are once again looking towards where will be the next level lower be before the Federal Reserve will act and put it in bid and unleash another round of quantitative easing or at what level the Federal Reserve folds with their interest rates tightening process.

There is now a new school of thought taking hold of “deficits do not matter” and as long as the continued stimulus is provided to the economy eventually everything will get better and if Japan can do it; Why can’t we?. There is no escaping debt, especially so when Interest rates have been kept low to such an extreme creating a situation of Zombification of the entire economy.

its this continued stimulus to the economy and these Keynesian ideas which has got the world in the big mess in the very first place. As a reminder the continued stimulus destroys fiscal balance sheets and today we have consumers, companies and governments maxing out on their credit lines and for all the new additions simply add capacity resulting in the worsening of the glut, evidently seen in real estate, infrastructure, car sales, etc while real utilization, growth, and demand has suffered. Japan at one time even mailed coupons money to spur their domestic consumption spending and it didn’t work yet the pundits today are floating ideas of “Universal Basic Income” as a means of one’s birth right to the “feed me” crowd who expect governments to provide cradle to grave support, while governments own fiscal balance sheets are so impaired, they may be hard to survive.

What comes next after bear markets is a recession and if its prolonged then it becomes a depression, something which the central banks will have to avoid at all cost as further downside is flashing red, “Sovereign Debt Crisis” alternatively the hunt for money begins with higher taxes as interest rates rise in tandem with this comes austerity next and further tightening of the economy, which may result in another period of Revolutionary Spring as seen in the first quarter of 2011, this time it could be worldwide.

Bear Markets have taken hold, the path forward beckons the question, inflate or deflate and no matter which way the outcome it’s filled with a whole lot of pain.

Conclusion: Deep structural policy reforms have to occur based on deployment of real metrics and the diversification of the underlying economy in earnest, hopefully with the coming pain the greatest motivator for change comes next as well.

Significant challenges remain ahead.

./ stay tuned.

Further Reading

{cognitive dissonance} Animal Spirits, Bubbles, Mania’s and Market Peaks. http://ul3.com/FIl46

{cognitive dissonance} FOMO Signs of the Euphoric. The Bust is almost near! http://ul3.com/6K2S3

{cognitive dissonance} BITCOIN – A Fraud and Ponzi in a Disillusioned World: http://ul3.com/35fH1

{cognitive dissonance} The Greed: http://ul3.com/pUDgd

The Hope: http://ul3.com/CuC7d

{cognitive dissonance} The Ignorant, Zombies: http://ul3.com/PP8Ez

{cognitive dissonance} Perception vs Reality: http://ul3.com/UcYb1

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

– Global Economic Collapse January 18, 2016