Dynamictrader.com/12/01/2018/ Daniel Mankani

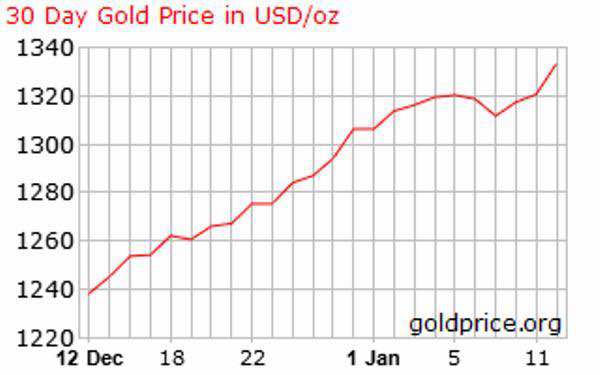

Last year GOLD Break at 1226 was based on the trump inflation trade, tax cuts and infrastructure spending boost, unleashing a call for revolution, “Lets Make America Great”, lets march on to even greater heights. The march forward, gold breaks 1326, Trumps the Dollar at 52 week lows, telling us “The Emperor is with no New Clothes”. Gold targets 1400 and even higher levels. Dollar Yen is back in “Safe Haven Play”. Expect Risk off traders to begin momentum. The bursting of all Bubbles and the Melt Up nearing its end.

GLOBAL WORLD STOCK MARKETS HEAT MAPS.

[stock_forex_markets_heat_map settings=”type=stock;background=#fff”]

EYES ON THE BALL: Gold bottomed in December 2015, similarly its around the same time many other major commodities bottomed as well. This break today of 1326 is making higher highs.

Friday’s high of almost 1340 is now approaching key resistance levels. In the manner and the strength of the rally, in my mind the momentum is strong enough targeting highest highs. A MARCH ON has began.

1400 is on the cards.

In 2017 alone gold settled 10% higher and dollar slumped the same. Whilst most of this gold gains coming in the last week of the year. On December 11th, we called the lows and here is why; In 2015:Gold Breaks 1226| This in itself was the first announcement gold rallies of highest high has began. It is notable of what a week change can do to personal annual portfolio’s. Just a week before December 11th 2017, Gold traded near 1237 lows. But it never did threaten 1226 again. You Know Why!.

Since that Gold Breaks 1226 report the Stock Market has marched on even higher. It feels a long time since then, but stocks a year ago and today have the greatest change as well as no meaningful correction for a very long time.

What’s going on? its was 43 days back then without the S&P having a meaning full correction. Now that period will be almost a year. { Gold Breaks 1226 }.Stocks and Gold have rallied even after the Federal Reserve Last Interest Rate Hike, both have marched higher!.

ANIMAL SPIRITS are ongoing, the melt-up continues and nearing another area of potential peaks. But how did we get here. fear of missing out as demonstrated in the fraud and a ponzi called crypto-currencies of which is also Bitcoin.

TRUMP the Emperor who has no Clothes.

Laugh and Know

But making fun of the high and mighty is what we do here at the Diary.

“Laugh and know,” said the Roman poet Martial. You can understand the pretensions… the foolish contradictions… and the absurd fantasies… only if you’re able to laugh at them.

Specifically, we were laughing at the way The Donald has bamboozled his own base. He talks their talk. But he walks the walk of the Deep State.

Mr. Trump is a showman.

quoting Frank Zappa, “politics is basically the entertainment arm of the military/industrial complex.”

We would add that it serves the social welfare/Wall Street complex, too. Trump – veteran reality TV star and professional wraslin’ fan – distracts the voters while the insiders pick their pockets.

An Emperor With No New Clothes.

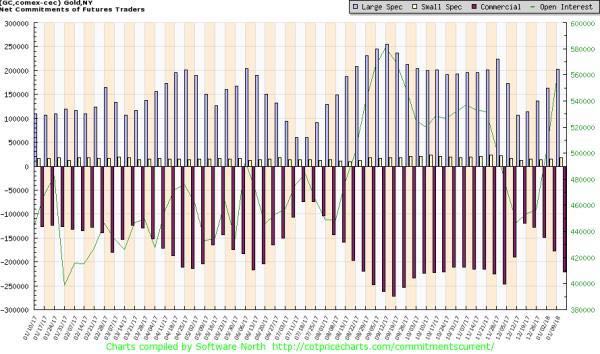

Its a great wikipedia story; What happens to Bullion Banks? What happens when those excessive contratual agreements which are more than the physical underlying begins to chase for the Physical, where none so exist as much as they have loaned out. What happens when the short covering begins? The unravelling of the 30’yrs low and lower low only, directional trade of Treasuries Bonds. What happens then?

Major FX Rates Changes

Dollar Closes at 52 weeks Lows on Friday.

Your guess is as good as mine!. Watch where the dollar is going? Its down 10% at the 52 weeks low and closing in to break in even lower. The last time this happened was in 2003. Look-up what happened in 2003! Also a republican and the start of world wars!

Gold Hits Highest High! “December 2012”. End of the World Rally!.

Last week Wednesday market reaction to “China may diversify send dollar tumbling and yields on the 10 yrs spooked at 2.63 highs. Since December 2015 gold has consistency made higher highs. Recent mining industry reports also suggest while demand grew in Asia, especially India and China for gold imports, gold annual production is in decline, additionally; China has become the highest gold producer in the world and do you see any external China Gold Exports???.

What happens? When contractual obligations are greater than the underlying?

Caveat Emptor in what you believe in. Complacency is at play across every society.

World Dollar Forex Heat Maps

[stock_forex_markets_heat_map settings=”type=forex;background=#fff”]

Watch where it is Green and Where it is Red. Look at FX Maps Above. When we break below the 90”s, dollar drops with momentum.

“Quoting from the dollar collapse blog.

Looking at just this one indicator, it would be reasonable to assume that gold’s all-too-brief run is about to end. But on the other side of this equation is the certainty that physical demand will eventually swamp these paper games and send gold and silver up in a bitcoin-worthy arc to their intrinsic values of $5,000/oz and $100/oz, respectively.

Therein lies the gold-bug’s dilemma. Precious metals will bounce around aimlessly – until they don’t – but the phase change won’t be obvious until after the fact. With that in mind, here are three possible approaches:

Avoid this asset class until a sustained uptrend is clearly established. That means waiting for, say, $1,500/oz before jumping in. So you give up a few hundred dollars an ounce in return for avoiding the pointless back-and-forth, but in the end still triple your money. Not bad.

Keep adding a little at a time. Each month buy a few silver coins or a few more gold mining shares and tune out the noise (such as this article), safe in the knowledge that eventually the dysfunctional global monetary system will come undone and capital will pour into the relative handful of safe haven assets like gold and silver, making the highs and lows of the before-times completely irrelevant. This is the best way to deal with incomplete knowledge of the future, and is therefore what most people should do.

Assume that this is it — that the current uptrend will soon go parabolic — and jump into precious metals with both feet. If it works, it’s one of those life-changing bets that everyone wishes they had the guts to make. If not, well, at least the downside is limited at this point.

The longer this goes on, the more attractive the third option becomes.

Trump the Dollar.

The March is on, your guess is as good as mine!.

LINKS

Disclaimer. http://ul3.com/L30qH

Back to the Beginning. http://ul3.com/aeVUG

BTAMSC – http://ul3.com/vAqdH

BITCOIN – A Fraud and Ponzi in a Disillusioned World: http://ul3.com/35fH1

The Greed: http://ul3.com/pUDgd

The Hope: http://ul3.com/CuC7d

The Ignorant, Zombies: http://ul3.com/PP8Ez

Perception vs Reality: http://ul3.com/UcYb1

History: http://ul3.com/1rCFA

Chart Patterns: http://ul3.com/ate6A

Introduction to Technical Analysis. http://ul3.com/kcYCE

Writings.

INTRODUCTION TO FINANCIAL MARKETS & TRADING OPPORTUNITIES IN COMMODITY, CURRENCY, & FINANCIAL FUTURES. http://ul3.com/dAFWj

Revolutionary Transformation Ongoing. http://ul3.com/kcYCE

– Global Economic Collapse January 18, 2016